Xerox is committed to supporting your financial well-being — today and tomorrow. The Xerox Corporation Savings Plan 401(k) through Voya helps you prepare for retirement by offering an easy, tax-advantaged way to save for your future financial needs.

Key advantages

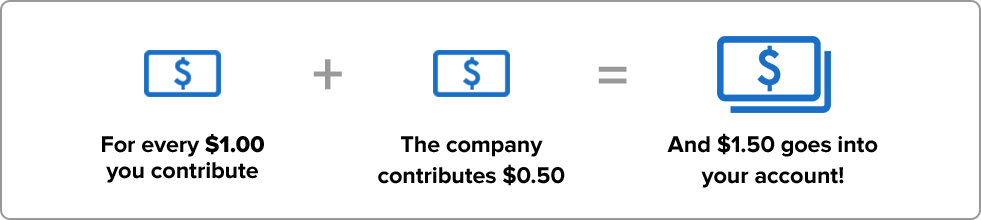

Company match of $0.50 on the dollar up to 6% of eligible earnings you contribute each calendar year on a Before-Tax and Roth basis

You can enroll or make changes at any time throughout the year

Tax-deferred investment growth

Wide range of investment options

Convenient payroll deductions

Manage your account

- Enroll in the plan.

- Check your balance.

- Change your contribution rate.

- Manage your investments.

- Update your beneficiary.

- Use planning tools and calculators.

- Access forms and documents.

Visit the Xerox 401(k) Savings Plan website or call the Xerox Retirement Service Center at 1.833.608.2886.

You may contribute a percentage of your eligible pay to your plan account, up to annual IRS limits, which are updated each year. The 2026 IRS limits allow you to contribute up to:

- $24,500 if you are under age 50

- $32,500 if you’re age 50 or older this year (which includes an additional $8,000 in catch-up contributions)

- $35,750 if you are between the ages of 60 and 63 by December 31, 2025 (which includes $11,250 in catch-up contributions)

Employees aged 50 or older who earned more than $150,000 in W-2 wages from Xerox in 2025 and want to make catch-up contributions, must make catch-up contributions into a Roth account on an after-tax basis, starting in 2026 .

Catch up!

It’s not too late to make up for lost time. If you’ll be 50 or older this year, take advantage of the opportunity to contribute up to an additional $8,000 in 2026.

When you contribute, Xerox does too! To support your retirement saving efforts, Xerox matches 50% of your Before-Tax and Roth contributions to the plan, up to 6% of your eligible pay. The Xerox contribution is made per pay period.

Here’s how the company match works:

Meet the match!

Are you making your money work as hard as you do? Try to contribute at least 6% to take full advantage of the match — otherwise, you’re leaving free money on the table.

It's important to designate a beneficiary to receive the value of your 401(k) account in the event of your death. As personal circumstances change, be sure to keep that information up-to-date. To add or update beneficiary(ies):

Visit the Xerox 401(k) Savings Plan website or call the Xerox Retirement Service Center at 1.833.608.2886.

Your investment mix consists of the funds you choose for your investments. This is an excellent opportunity to review your current investment mix and access the tools provided to see if you are on track to reach your goals. If you decide to make changes, you may consider reallocating your current balance, changing how your contributions will be invested going forward, or both. To review or change your investment mix:

Visit the Xerox 401(k) Savings Plan website or call the Xerox Retirement Service Center at 1.833.608.2886.